The two featured speakers on the first day of the National Fluid Power Association’s annual International Economic Outlook Conference, Alan Beaulieu of the Institute for Trend Research and Eli Lustgarten of ESL Consultants Inc., have earned a bit of a reputation as doomsayers to IEOC regulars. But this year, the feeling was decidedly upbeat after their presentations. And the crowd—a record 319 registered for this year’s event at the Westin Chicago North Shore—was more than ready to hear it.

The two featured speakers on the first day of the National Fluid Power Association’s annual International Economic Outlook Conference, Alan Beaulieu of the Institute for Trend Research and Eli Lustgarten of ESL Consultants Inc., have earned a bit of a reputation as doomsayers to IEOC regulars. But this year, the feeling was decidedly upbeat after their presentations. And the crowd—a record 319 registered for this year’s event at the Westin Chicago North Shore—was more than ready to hear it.

“The world is presenting you with more and more opportunities. The world is a good place right now in this industry,” Beaulieu said.

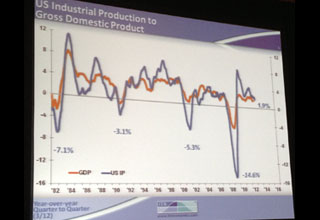

Beaulieu told the audience that the next significant recession will be in 2019. He explained that it would not as bad as the 2008-2009 event, but worse than the small recession he predicts for 2014—overall, a similar recession to what was experienced in the U.S. in 2001.

Several reasons indicate a recovery for this year:

• Leading indicators pointing up for 2013

• Liquidity is not an issue

• The U.S. has become a major producer of energy

• There is a stimulative monitory policy for now

• Employment is rising (companies are finally right sized)

• Banks are lending

• Retail sales are good. Household net worth is up again; other countries will benefit from the fact that American consumers will be spending more over the next five years, and

• Construction spending is improving.

Manufacturing is on the ascent here in the U.S., Beaulieu said, because companies are leaving Europe, China and other parts of the world because of our natural gas and energy availability. The thing most hurting the country is the corporate tax structure, he said.

• His areas of concern included:

• Europe’s financial troubles

• China recession/housing bubble?

• Massive legislative changes

• Israel and Iran

• Fiscal cliff

• Tax hikes

• Massive deficit and growing national national debt

He had positive things to say about how Canada will balance its budget by 2015 and begin to pay down its debt starting in 2016. And he was practically through the roof about Mexico, in spite of the dangerous conditions in parts of that country.

“Mexico has so much potential, it’s incredible,” Beaulieu said. “This is a place where you have to be deciding how you are going to do business [there].”

Other areas of interest:

Europe. The recession is over. Manufacturing is going up. Europe industrial production is going to rise from now until the middle of 2014. Then it will soften again into the first half of 2015.

Brazil. They’re going to eat aggressive on inflation. Brazil is going to head toward a tough 2014, and especially the second half “will go bad in a hurry.” Nice growth in 2015. Long term news there is good, and the upcoming World Cup and Olympics there will be positives.

Russia. Industrial production down. Growth rate actually picks up in 2014 off a slow 2013. Energy will help. Beaulieu is not a fan of long term investments there. “It is unstable and there are a whole host of opportunities elsewhere,” he said.

China: This will be a successful nation for the next 15-20 years.

Australia. Tracks with U.S.; economy is the size of California’s. Will bounce back nicely in 2015. Exports to China are on the ascent. Retail sales are good. This economy has a lot of opportunities ahead of it. It has minerals and it has a huge trading partner next door.

Beaulieu believes the biggest opportunities over the next 15-20 years will be in these sectors:

• Energy distribution

• Water distribution/conservation

• Exports from U.S.

• Vocational education

• Health care

• Food

• Mexico

• Housing

• Funeral services

• Alcohol

• Security

• 3-D printing

• Natural resources (harvesting/conserving)

• Entertainment

Tomorrow: Hear what Eli Lustgarten and Eric Lanke had to say.

If we can get rid of most of the regulations on business, and reduce the tax burden on business, THEN, and only then, will we be able to have a robust economy!