As it came up on the three-month mark for its acquisition of Eaton Hydraulics, I spoke with Eric Alström, president of Danfoss Power Solutions, about how the merger is going between the two companies and what the future holds. The conversation was positive, echoing the continued growth of the company that was highlighted over the past 18 months since the acquisition was announced.

“It’s just terrific to see the spirit and mindset of all of our people coming together and we’ve been careful of calling this the new Danfoss Power Solutions, so that employees from legacy Eaton Hydraulics are as welcome to the new Danfoss Power Solutions as legacy Danfoss employees because we want to create that sort of platform of unity. Nobody should feel like a little sister or little brother, we’re equals coming together, creating something brand new and fantastic,” Alström said. “It’s going beyond expectation and I’m just immensely proud of what we have accomplished on both sides. It’s incredibly smooth. We’ve had virtually only minor hiccups, even complex IT systems coming together is working out just fantastic.”

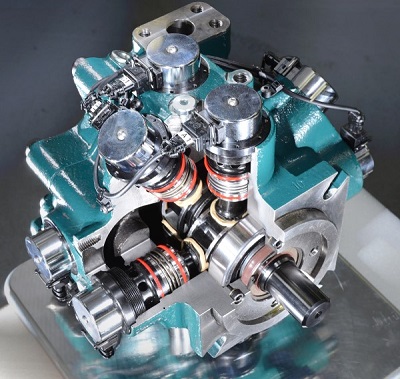

A powerhouse of hydraulics

The acquisition has allowed Danfoss to expand its market offerings, making it one of the biggest hydraulics companies in the world. Eaton Corp. retained its filtration and golf grips divisions, but the acquisition focused primarily on the hydraulics side of Eaton’s business, including its fluid conveyance divisions of hose and fittings. “This is part of the excitement, of course, because on the product side, that’s a huge change for us,” Alström said. “Another one, frankly, is the fact that we also have now an industrial product portfolio, which we never had before. And both of those — fluid conveyance and industrial products — are nothing that you sort of organically just start building from scratch. You have to acquire something. And we’re immensely happy that we could make that happen.”

Alström added that Eaton brought a strong distribution channel and an even stronger manufacturing footprint to Danfoss Power Solutions, with new or expanded locations in South Korea, Japan, Mexico, and India, which are markets of the future for Danfoss as well.

Adding the Eaton team and the Eaton facilities was a boon to Danfoss Power Solutions, Alström noted, because the company was out of capacity in that area. “We’ve grown so much over the last years that we needed to look at new footprints and new plant locations and so on. So this is actually a blessing,” he said. “Now we look if there are opportunities to put different products in new plants, meaning legacy plants from Eaton Hydraulics as well and vice versa for that matter because some of the Eaton locations are full too. So that’s another sort of great benefit of coming together.”

Alström said they were disappointed and surprised they had to divest the orbital motors and steering valves business based upon regulators in the European Union and in the US. “That was quite painful. It was quite unexpected. We had to say goodbye to 800 loyal employees on both sides. But they landed in a good company (Interpump), which is where hydraulics is also core.”

Alström said they were disappointed and surprised they had to divest the orbital motors and steering valves business based upon regulators in the European Union and in the US. “That was quite painful. It was quite unexpected. We had to say goodbye to 800 loyal employees on both sides. But they landed in a good company (Interpump), which is where hydraulics is also core.”

As for complimentary product lines, such as Eaton’s Dynamic Machine Control software and Danfoss’ PLUS+1 system, Alström said they are currently reviewing both platforms software and hardware portfolios to determine how to move forward. “We’re looking at the strengths and the gaps in the product portfolio and how do we need to fine tune and streamline that going forward,” he said. “I think both software platforms are quite popular, particularly with our distribution partners, and we want to make sure that we can service both distributors who have been working with the Eaton platform and with the Danfoss platform going forward. And exactly how we do that going forward with one platform is exactly we’re working out now. The vision is that we probably would have one platform going forward that will be with the same functionality to satisfy distribution partners in both legacy businesses.”

Building stronger distributor relationships

Distributors are an extremely important relationship, Alström noted, as we discussed Eaton’s Distributor Meeting that the company held annually to introduce and train its distributors on new technologies. Danfoss had planned to hold the meeting in 2021 but postponed until next year due to Covid-19. The annual meeting for distributors will be held in all major regions where Danfoss has a presence next year, he said.

“The Eaton event is renowned in the industry. Everybody knows about it, and everybody speaks very highly of it. And I have to say that’s just one example of something where we would like to model a best practice from Eaton Hydraulics,” Alström said. “And there are many of those examples where we can learn from each other. And so, this event for sure will be done going forward and in the same grand way that Eaton hydraulics did it in the past.”

Honing in on autonomous machinery and electrification

Two major trends in the industry are autonomous machinery and electrification and Alström noted that both companies bring individual strengths in those areas.

“There are pockets of excellence on both sides. Turns out that Eaton Hydraulics has been working on autonomous solutions in their Kameoka location in Japan which is complementary to what we are working on with our business unit, based out of Cambridge, Massachusetts.

“We want to make sure that we stay ahead here, because I think there’s a very compelling use case in the off-highway industry versus on-highway automotive. If you think about passenger cars, I don’t think anybody wants to pay $40,000 to $80,000 for having an autonomous solution on a car. I think that it’s going to take a long time for the use case to be acceptable for people to pay; cost has to come down. But today already we have compelling use cases in off highway.

“We are already delivering serial production solutions to airport container handling equipment. That’s a great use case where frankly, a human being can run into the fuselage of the aircraft and damage it, while our autonomous solution prohibits that from happening, thus ensuring uptime of an aircraft. But there are many of these use cases where it’s much safer, it’s much more productive and much easier to justify the investment in an autonomous system because it’s a safe environment.”

Similarly, on the electrification side, Danfoss has been the stronger partner and continues to invest in it, especially with its Editron business unit. “This business is one of those where we are investing a lot, and also where we are reaping the highest growth rates, where Editron is growing by excess of 40% per year right now in off highway,” he said.

Another vertical Danfoss sees electrification moving in is the marine market, where Danfoss has a propulsion system portfolio, which ranges from 120 kW up to 5 or 6 MW of power. “This is a range that nobody can match at the moment,” he said.

“It’s fun because we really found an area where all the capability is of Danfoss as a group together, where we have our colleagues in the Danfoss drive segment that have been working with inverter and converter technology for years, and also silicon power, which is to empower modules for both conventional cars, but also electrical cars. And that’s another strong differentiation aspect, which we are proud to have in our portfolio.

“Now, of course, energy and power density still speaks in favor of hydraulics in many of the use cases or in many of the applications, but we’re also seeing street sweepers, mini-excavators, those type of areas are electrifying faster than many expected and we are there.”

No denying the power of hydraulics

Danfoss sees the future of electrification as one where the hydraulics and electrical drive systems work together to be the most efficient, powerful machine available.

“We’re investing a lot in it now, so that when there is a substitution effect in favor of electrification, we got it. But there will still be hydraulic power in these machines because some of the functions, and even sometimes the propel function still needs to be hydraulic because of the power ranges that are needed,” Alström. “But there are also other cases where we have lots of serial equipment out there right now in a hybrid mode, such as forest machinery, like forwarders that are working in the forest of Finland.

“And we have many of those cases right now where electrical and hydraulic becomes a perfect combination. And if you then add updated digital displacement technology where we now have digitally controlled piston pumps, this is a game changer, right? If you just look at the digital displacement pump alone, you’re looking at efficiency gains of anywhere between 30 to 45%, depending on the application. And for many of the customers, productivity is as important. And we have the same range of productivity improvement on our digital displacement pump. And now we combine that with electrical power in machines as well. And we come up with complete use cases for applications.

“So it’s fun, there’s so much happening. All those that think that hydraulics is a sort of dinosaur technology, well guess what, there’s still huge changes happening as we sit here.”

The future is bright

As for how customers perceive the new company, Alström believes they are fairly optimistic about the future of Danfoss as it has doubled in size. “We are now entering into a mode where we can support all of our customers much better than before. And I think that’s important that we’re not just thinking selfishly here, all the cool things that we are doing, but we’re actually thinking also how we can become a better partner for our customers, large and small.

“And we try to emphasize that this is really a growth story. We’re adding about 800 engineers, so we’re going to have roundabout 1,700 engineers and adding about 800-900 sales people. We’re doubling the size of our sales team and we’re not trying to do cost reduction ideas and reducing the size of these entities; it’s quite the opposite. Instead, we’re looking at how can we service our customers better? How can we create more — faster — with all these resources that we have coming on board?”

Hydraulics will always be at the core of Danfoss, he reiterated. “We’re continuing to invest in core technologies where we are strong today. We still continue to improve our core because there’s still lots of improvement opportunity there.

“Hydraulics is core, and hydraulics is half of our revenue, right? So it’s something that we still are absolutely committed to and believe in for the future and not just for the near future, but for the long term,” Alström concluded. “Yes, there will be electrohydraulic solutions, but hydraulics will always play a role in complicated and high-power drive applications. There will always be hydraulics. So, we’re very bullish on our future here.”

Danfoss Power Solutions

danfoss.com