A growing share of agricultural vehicle production and a shrinking captive market has crowned APAC the top region for mobile hydraulic sales. This finding comes after a six-month research cycle conducted by research firm, Interact Analysis. During this time, 40+ hours of interviews were conducted with industry insiders in an effort to build accurate estimates for the size and growth of the mobile hydraulic market. The recently published report examines the market for hydraulic pumps, motors, valves, and cylinders sold into mobile applications and offers data & analysis by vehicle type, sector, and region.

Seeds of change

Agriculture is one of the most important sectors to the mobile hydraulic market. The mix of high volume and mid-to-high average selling prices for hydraulic components sold into the sector have allowed it to compete with construction as a top sector for hydraulic sales. During the research, demand for hydraulics was modelled from known vehicle production numbers. Interestingly, the production of agricultural vehicles has seen rapid change in the last decade which will have huge implications for the regional mix of hydraulic sales going forward.

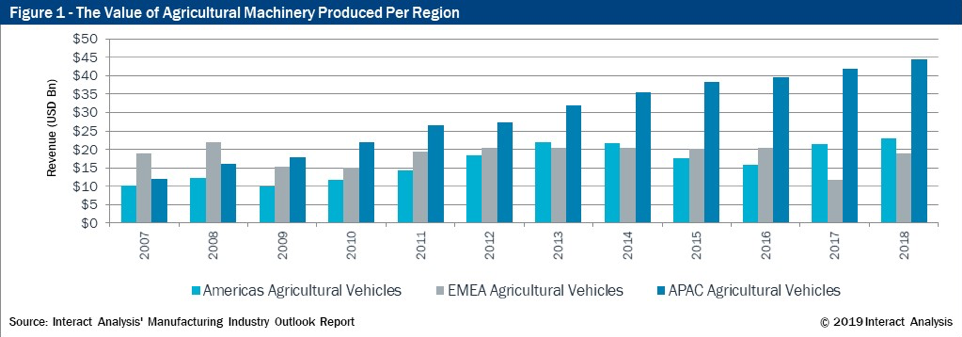

Using data sourced from official country statistics dating back pre-recession to 2007, we found that growth in agricultural vehicle production has become stagnant in EMEA and has exploded in APAC. The chart below shows the value of agricultural vehicles produced in U.S. dollar terms using a 11-year fixed average exchange rate.

As you can clearly see, vehicle production in APAC has more than tripled over the last 11 years, whereas EMEA’s vehicle production is nearly the exact size it was in 2007. Much of the high growth in APAC is linked to the generally increasing rates of mechanization on farms in the region. EMEA on the other hand is quite a mature market for agricultural machinery and as such is already very heavily mechanized.

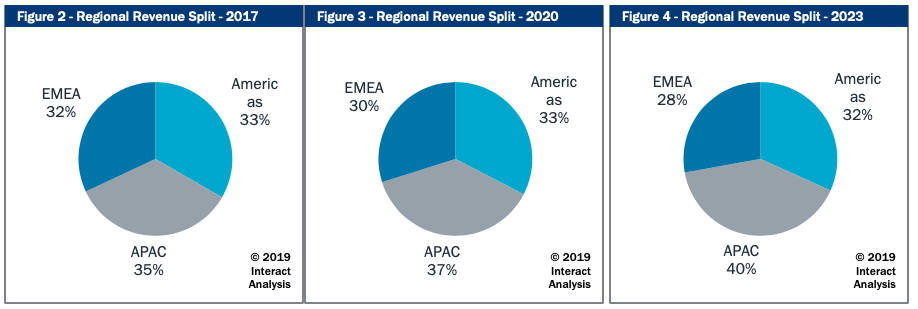

EMEA has historically been considered the largest market for mobile hydraulics. However, this changed in 2017 when APAC took over the number one spot following strong growth in both its construction and agricultural sectors. Meanwhile, EMEA slipped to last after a historically bad year in its agricultural machinery production (shown above) and a general stagnation amongst many of its other traditional hydraulic sectors. The below figures show the regional shifting of hydraulic revenues over the next five years.

Release the captive

APAC is expected to gain even more share over the Americas and EMEA as the region’s captive market begins to shrink. APAC has by far the highest prevalence of in-house production by vehicle OEMs of any region. A history of long lead times from international suppliers and a desire for greater flexibility in their manufacturing processes has led to this. However, according to interviews conducted during our research, several major vehicle OEMs are beginning to scale down their in-house production in favor of sourcing hydraulics from local suppliers. Hydraulics supplier Hengli Hydraulics is a prime example of the success that can be enjoyed as a result of this. In just two years, the company went from not supplying hydraulic pumps to excavators, to having an estimated 60% share in China in 2016. This success is largely attributed to both the decreasing captive market, and the increasing demand by vehicle OEMs for localized hydraulic suppliers.

Both of these trends are important for hydraulic suppliers to consider as they decide which areas of their business to invest in for the years to come. Interact Analysis’ “Mobile Hydraulic Market – 2019” report explores these trends in greater detail and also offers analysis of the market by vehicle type, product, sector, and region. The report is comprised of two excel files containing 140 market size/forecast tables and 20 market share tables respectively, a 70-slide power point, and a powerBI dashboard which allows users to visualize the data according to their own unique needs. If you are interested in attaining the report, please contact blake.griffin@interactanalysis.com.